Getting Started¶

Setup¶

Follow the installation instructions from the README.md file

git clone https://github.com/mellow-finance/mellow-strategy-sdk.git

cd mellow-strategy-sdk

python3 -m venv .venv

source .venv/bin/activate

pip install poetry==1.1.13

poetry install

The easiest way to get started is to clone SDK and use examples in the Github repo.

The notebook with this code is also in the examples.

Choose pool¶

A typical notebook would start with downloading and preparing data for a specific pool.

POOLS is a list of available pools, let’s choose 1 it is WBTC/WETH, fee 0.3%

from strategy.primitives import POOLS, Pool

pool_num = 1

my_pool = Pool(

tokenA=POOLS[pool_num]['token0'],

tokenB=POOLS[pool_num]['token1'],

fee=POOLS[pool_num]['fee']

)

Get data¶

For each pool at the first run you need to download the data

from strategy.data import DownloaderRawDataUniV3

# downloads mint, burn, swap for the pool, this needs to be done once the files are added to ../data/

# ~5min

DownloaderRawDataUniV3().load_events(pool_num)

You also you can use strategy.data.SyntheticData or utilities.utilities.get_data_from_binance

After loading the data, they can be read locally. Сreate an object with pool data.

from strategy.data import RawDataUniV3

data = RawDataUniV3(my_pool).load_from_folder()

Create strategy¶

from strategy.strategies import AbstractStrategy

from strategy.uniswap_utils import UniswapLiquidityAligner

from strategy.positions import UniV3Position

class UniV3Passive(AbstractStrategy):

"""

``UniV3Passive`` is the passive strategy on UniswapV3 without rebalances.

i.e. mint interval and wait.

lower_price: Lower bound of the interval

upper_price: Upper bound of the interval

rebalance_cost: Rebalancing cost, expressed in currency

pool: UniswapV3 Pool instance

name: Unique name for the instance

"""

def __init__(self,

lower_price: float,

upper_price: float,

pool: Pool,

rebalance_cost: float,

name: str = None,

):

super().__init__(name)

self.lower_price = lower_price

self.upper_price = upper_price

self.decimal_diff = -pool.decimals_diff

self.fee_percent = pool.fee.percent

self.rebalance_cost = rebalance_cost

def rebalance(self, *args, **kwargs) -> str:

timestamp = kwargs['timestamp']

row = kwargs['row']

portfolio = kwargs['portfolio']

price_before, price = row['price_before'], row['price']

if len(portfolio.positions) == 0:

univ3_pos = self.create_uni_position(price)

portfolio.append(univ3_pos)

return 'mint'

uni_pos = portfolio.get_position('UniV3Passive')

uni_pos.charge_fees(price_before, price)

def create_uni_position(self, price):

univ3_pos = UniV3Position('UniV3Passive', self.lower_price, self.upper_price, self.fee_percent, self.rebalance_cost)

x_uni_aligned, y_uni_aligned = univ3_pos.swap_to_optimal(x=1 / price, y=1, price=price)

univ3_pos.deposit(x=x_uni_aligned, y=y_uni_aligned, price=price)

return univ3_pos

Typycally the definition of the rebalance method would contain two sections:

- Init

On the first call you need to initialize strategy’s portfolio under management. Here you need to create initial positions with

appendmethod ofstrategies.portfolio.Portfolio()and invest initial amount usingdepositmethod.

- Rebalance

In this section you decide if you want to rebalance or not. If you rebalance you need to implement the logic of rebalance.

Backtest¶

Next step is to run backtest using your strategy and data:

from strategy.backtest import Backtest

univ3_passive = UniV3Passive(

lower_price=data.swaps['price'].min(),

upper_price=data.swaps['price'].max(),

pool=pool,

rebalance_cost=0.,

name='passive'

)

b = Backtest(univ3_passive)

portfolio_history, rebalance_history, uni_history = b.backtest(data.swaps)

Visualize¶

Next visualize results

from strategy.viewers import RebalanceViewer, UniswapViewer, PotrfolioViewer

import plotly.offline as pyo

import plotly.graph_objs as go

rv = RebalanceViewer(rebalance_history)

uv = UniswapViewer(uni_history)

pv = PotrfolioViewer(portfolio_history, pool)

# Draw portfolio stats, like value, fees earned, apy

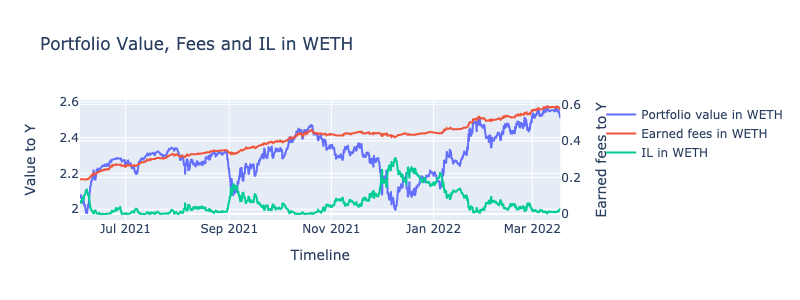

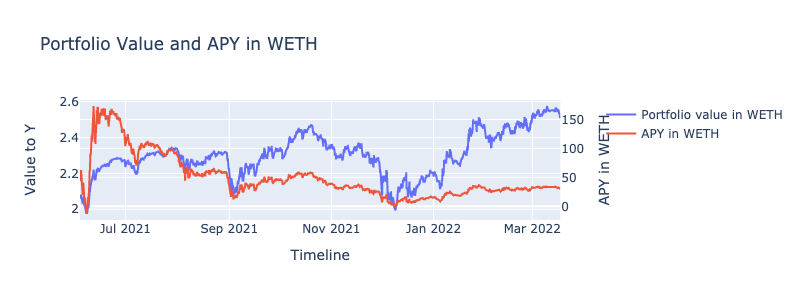

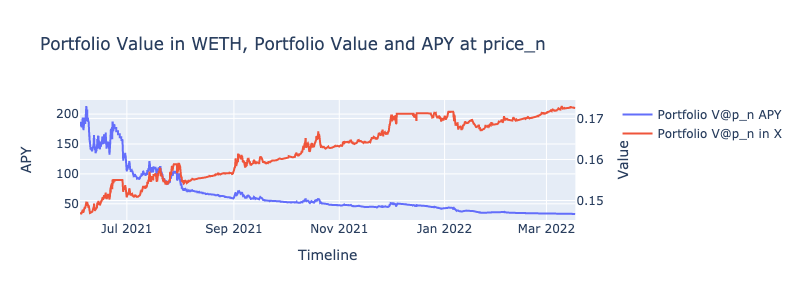

fig1, fig2, fig3, fig4, fig5, fig6 = pv.draw_portfolio()

# Draw Uniswap intervals

intervals_plot = uv.draw_intervals(data.swaps)

# Draw rebalances

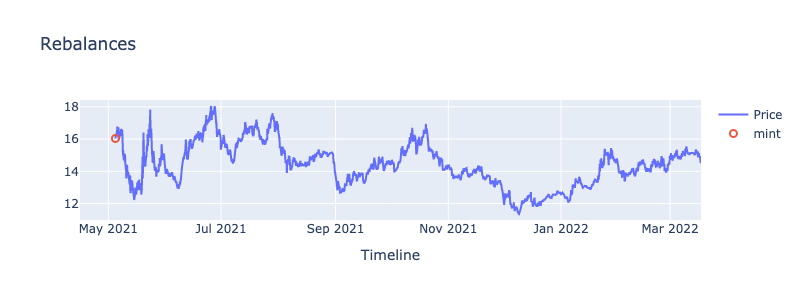

rebalances_plot = rv.draw_rebalances(data.swaps)

# Calculate df with portfolio stats

stats = portfolio_history.calculate_stats()

intervals_plot.update_layout(height=300, width=800).write_image("intervals_plot.png")

rebalances_plot.update_layout(height=300, width=800).show()

fig2.update_layout(height=300, width=800).show()

fig4.update_layout(height=300, width=800).show()

fig6.update_layout(height=300, width=800).show()

stats.tail(3)

timestamp |

price |

total_value_x |

total_value_y |

total_il_x |

total_il_y |

total_fees_x |

total_fees_y |

total_value_to_x |

total_value_to_y |

total_fees_to_x |

total_fees_to_y |

total_il_to_x |

total_il_to_y |

hold_to_x |

hold_to_y |

vpn_value |

vpn_hold |

portfolio_apy_x |

portfolio_apy_y |

hold_apy_x |

hold_apy_y |

vpn_apy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2022-03-17T17:12:32.024000000 |

14.580860285519847 |

0.08438109390436045 |

1.283817410373051 |

-0.039848089756931424 |

0.6093134770111877 |

0.019824508912898182 |

0.2893447834426407 |

0.17242921899667762 |

2.5141663513318613 |

0.039668659242627836 |

0.578403178130652 |

0.0019404923349148756 |

0.028294047620516016 |

0.13470105208896468 |

1.9640572208217253 |

0.1725279260223562 |

0.13482436008811285 |

45.3704504013658 |

30.24819845834532 |

9.296761797586672 |

-2.0729021464680364 |

32.952626752710316 |

2022-03-17T17:50:59.008000000 |

14.566802837652778 |

0.0847962980188726 |

1.27778439529345 |

-0.040262051984760086 |

0.6153464920907888 |

0.019825750799581668 |

0.2893447834426407 |

0.17251523054884332 |

2.5129953498972144 |

0.039689051392538977 |

0.5781425864485839 |

0.0019810193980844618 |

0.028857118989461972 |

0.1348071985543888 |

1.963709882438092 |

0.17252890365645912 |

0.13482436008811285 |

45.454211937843915 |

30.1781295681117 |

9.396250588567012 |

-2.0929054328821084 |

32.95349695422687 |

2022-03-17T18:06:55.268000000 |

14.564532604580709 |

0.08486340853404364 |

1.2768098095889577 |

-0.040328961770573685 |

0.6163210777952812 |

0.01982595152893911 |

0.2893447834426407 |

0.17252909917126924 |

2.5128056901188893 |

0.03969234829553624 |

0.5781005009027111 |

0.001987609212379886 |

0.028948599178871826 |

0.13482436008811285 |

1.9636537883950496 |

0.17252909917126924 |

0.13482436008811285 |

45.467718370952916 |

30.166781424547274 |

9.41233686472187 |

-2.0961358484948067 |

32.953670983931296 |

Congratulations! Now you have the results of your strategy backtest on the real UniV3 data!